Scope and Career Opportunities after MSW Degree

A social worker makes a major contribution to transforming

the lives of individuals and communities and...

2 Years

ODL

Renowned ANU university ODL degree

Distance mode suits banking sector employees

Financial markets, risk management, operations expertise

Fast-track banking, fintech, financial institution growth

The Master of Commerce (Banking) is a postgraduate program designed to equip students with advanced knowledge and skills essential for a successful career in the banking and financial sectors. This comprehensive program delves deep into various aspects of banking, including financial management, investment strategies, risk assessment, and regulatory frameworks. By blending theoretical foundations with practical applications, the course ensures that graduates are well-prepared to navigate the complexities of the modern financial world.

One of the key strengths of the M.com in Banking distance education is its industry-relevant curriculum. Students engage with real-world case studies, gaining insights into current banking trends and challenges. The program also emphasizes the development of specialized knowledge in critical areas such as investment banking, financial analysis, credit management, and risk management. This allows students to tailor their education to their career aspirations, making them highly competitive in the job market. Graduates can pursue diverse roles such as financial analysts, investment bankers, credit managers, and risk consultants, with the potential to advance to senior positions within financial institutions and regulatory bodies.

M.com in Banking is an excellent choice for students seeking to deepen their expertise in banking and finance, advance their careers, and build a robust professional network.

Bcom / BBM

The pass, class, grace rules approved for the award of M.Com Degree offered by ANU to students under the regular mode will be applicable to the students opting ‘ICT Mode’

Specialized training in central banking and developmental banking

Coverage of international banking, International Financial Markets and Services

Focus on Insurance and Risk Management, Banking Law and Practice, Banking and Technology

Distance learning ideal for banking sector professionals

Career advancement in banks, financial institutions, and fintech companies

| Subject | Type |

|---|---|

| Perspectives of Management | Compulsory |

| Business Environment | Compulsory |

| Marketing Management-I | Compulsory |

| Financial Management-I | Compulsory |

| Human Resource Management-I | Compulsory |

| Financial Accounting and Packages | Compulsory |

| Subject | Type |

|---|---|

| Central Banking and Development Banking | Compulsory |

| Marketing Management-II | Compulsory |

| Business Statistics | Compulsory |

| Human Resource Management-II | Compulsory |

| Advanced Financial Accounting | Compulsory |

| Research Methodology | Compulsory |

| Subject | Type |

|---|---|

| International Banking | Compulsory |

| International Financial Markets and Services | Compulsory |

| Insurance and Risk Management | Compulsory |

| Financial Reporting | Compulsory |

| Entrepreneurship Development | Compulsory |

| Finance of Foreign Trade | Compulsory |

| Subject | Type |

|---|---|

| Semester IV | |

| Banking Law and Practice | Compulsory |

| Portfolio Management | Compulsory |

| Banking and Technology | Compulsory |

| Bank Management | Compulsory |

| Business Correspondence and Report Writing | Compulsory |

| General Insurance products and Management | Compulsory |

Total Credits

100

| M.Com Banking | ||||||||

|---|---|---|---|---|---|---|---|---|

| 1 Year | 2 Year | |||||||

| Yearly Fee | ₹ 6,730 | ₹ 8,750 | ||||||

| Total Fee | ₹ 15,480 | |||||||

| *No Cost EMI options available | ||||||||

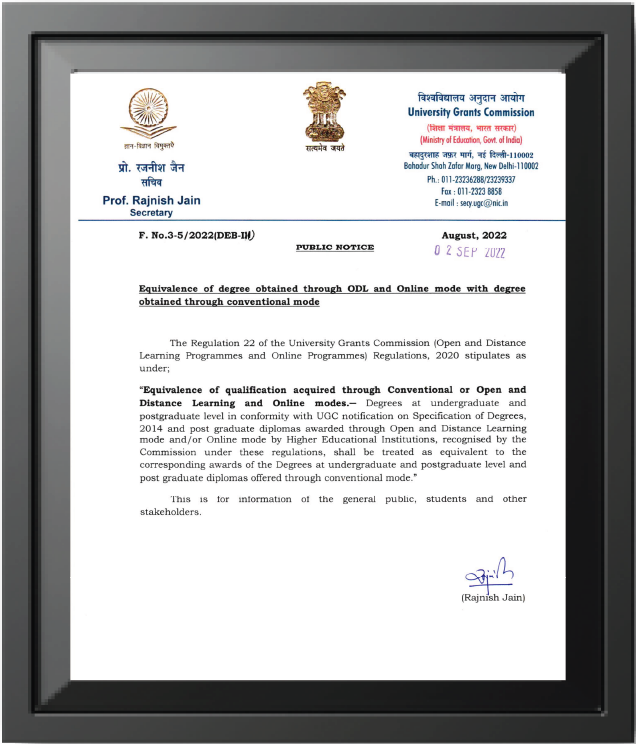

According to Regulation 22 of the UGC in 2020, online degrees are now considered just as valid & credible as traditional, offline degrees.

1

1

2

2

3

3

4

4

5

5

Questions about admissions or career outcomes? Our experienced counsellors are here to provide personalized guidance and help you make the best decision for your future.

Enquire Now